This is the first in a series of field dispatches focused on the convergence of climate change, mining, renewable energy, and their profound effect on the Desert West.

Lithium is the lightest metal on the periodic table and the third lightest chemical element after helium and hydrogen, but unlike them, lithium is solid under standard conditions. This silvery-white metal is highly volatile—it will burst into flames when it encounters water. In its salt form, lithium is prescribed as a mood stabilizer for bipolar disorder and other psychiatric conditions. During the atomic age, lithium deuteride was an essential fuel component for the Castle Bravo thermonuclear device—the largest hydrogen bomb detonated by the United States.[1] Before Sony commercialized portable rechargeable lithium-ion batteries during the 1990s, lithium’s main industrial uses were largely limited to glassmaking, ceramics, lubricants, and flux additives for iron, steel, and aluminum production.

Lithium’s alkaline reactivity produces significant quantities of innate energy in a small, extremely light but dense, storable package, making the metal nearly ideal [2] for producing rechargeable batteries. Refined lithium, such as lithium carbonate and lithium hydroxide, are essential components for producing lithium-ion electric vehicle (EV) batteries, energy storage, and for powering the portable electronic devices we depend on daily. Indeed, nearly 90 percent of the world’s 2023 end-use lithium supply was relegated to rechargeable batteries.[3] It is expected that by 2030, over half of U.S. new-car sales will be EVs. Therefore, lithium has been promoted as indispensable for decarbonizing the nation’s transportation sector—our largest greenhouse gas emission source.

According to the International Energy Agency (IEA), 240 to 380 million EVs must replace gas-powered vehicles by 2030 worldwide to reach global net-zero emission targets by 2050, accelerating exploration for new lithium resources.[4] Considering that a typical lithium-ion EV car battery requires 113 pounds of lithium carbonate equivalent (LCE),[5] global demand for lithium has increased rapidly; from 2010 to 2020, production tripled and is expected to climb eighteen to twenty-fold by 2050. As newer, more sustainable lithium production technologies, such as Direct Lithium Extraction (DLE), are brought to commercial scale, demand for lithium could skyrocket as much as forty-fold by 2050.[6]

Fortunately for humankind, lithium is relatively abundant. The U.S. Geological Survey estimates that 98 million tons of lithium resources exist worldwide.[7] Lithium is found in three types of geological deposits, listed here in order of resource abundance: closed-basin brines, pegmatites, and sedimentary claystone. Brines are categorized as continental, geothermal, or oilfield. Each type varies in chemical composition and concentration depending on the source and location. Closed-basin brines makeup approximately sixty percent of global lithium reserves. Pegmatite hardrock sources add another thirty percent, and the remaining ten percent is contained in claystone deposits.[8] According to the U.S. Department of Energy, seventy percent of the U.S. lithium reserves are brines. Brines deemed profitable for extraction contain 200 – 4,000 milligrams per liter (mg/l) of dissolved lithium, but most commercial operations hover at 200 mg/l.[9] Hardrock deposits provide the most concentrated source of lithium.

Currently, the U.S. domestically sources less than one percent of its lithium supply. The rest is imported from South America’s “Lithium Triangle,” or Puna de Atacama,[10] where more than 53 percent of the world’s lithium resources lay under visually stunning salares or salt flats in a triangulated arid region of Argentina, Bolivia, and Chile.[11] Over millions of years, continental brines collected in aquifers beneath the salares as water seeped through lithium-bearing rocks, slowly dissolving the metal and other minerals into a salt-laden soup. These lithium-chloride-rich brines are pumped to the surface from underground reservoirs into solar evaporation ponds that are so expansive they can be viewed from space. This slow process takes 18 to 24 months and requires prodigious amounts of fresh water to produce LCE. Notably, this land-intensive process can recover only 40 to 60 percent of the lithium contained in the brine.

Australia, for now, is the largest supplier of LCE, producing more than half of the worldwide supply from a pegmatitic igneous mineral called spodumene.[12] This ore, once mined and chemically treated with sulfuric acid and other chemicals to extract the lithium, is then shipped to Australia’s largest buyer, China, for further refinement and use in battery production facilities. Notably, China currently produces 75 percent of the world’s lithium-ion batteries.[13] Overall, hardrock mining is the most expensive and carbon-intensive lithium extraction process because it requires vast amounts of fossil fuel at all stages of production, including mining, refining, and transport. Overall, mining contributes 4 to 7 percent of global greenhouse gas emissions.[14]

Evaporative and hardrock lithium mining is environmentally destructive. Both practices physically transform the landscape; lithium produced through traditional hardrock mining involves excavating, blasting, crushing, milling, and roasting ore before chemical separation, making it an extremely energy-intensive process. Not only does hardrock mining create a huge open pit while generating tremendous amounts of waste rock and tailings, it requires, on average, 250,000 gallons of water and releases 9.6 to 17.1 tons of carbon dioxide (CO₂) per ton of LCE produced, depending on the resulting end-product. In contrast, the evaporative technique contributes from 2.8 to 5.7 tons of CO₂ per metric ton processed.[15] However, the physical footprint of a hardrock open-pit mine is still smaller than that of a sprawling 3,000-acre evaporative brine operation.

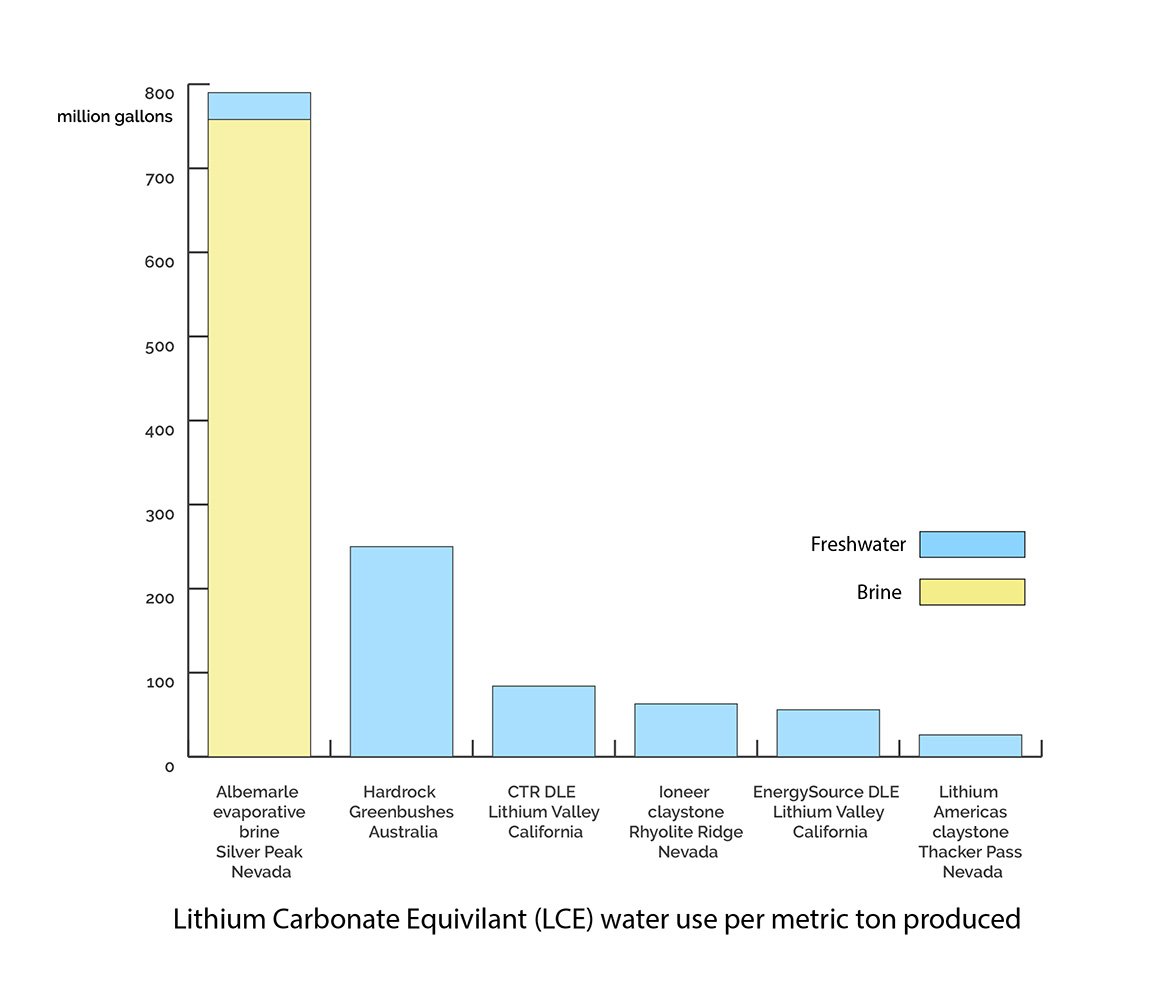

Although the carbon footprint of evaporative brine processing is substantially less, it is also more water-intensive than hardrock mining and, in turn, threatens surface and groundwater supplies in areas where this type of lithium mining occurs. Evaporative brine processing in Chile’s Salar de Atacama, one of the driest places on Earth, typically requires over 500,000 gallons of combined brine and freshwater for every metric ton of LCE produced, with 95 percent of this water being lost through evaporation.[16] Wired UK stated in 2018 that sixty-five percent of the region’s groundwater has been depleted from lithium carbonate production. Chemicals used in brine processing, including hydrochloric acid, can contaminate drinking water supplies, streams, wetlands, and rivers. Saltwater incursion can occur when freshwater at the salar edges is pumped for related industrial purposes or if it flows into a hydrologically linked freshwater aquifer. Huge amounts of waste rock and hazardous byproducts must be properly disposed of. Overall, ecosystem biodiversity is threatened and greatly diminished where the salar brine operations exist.

Not surprisingly, large public protests driven by the intertwined socio-ecological impacts of industrialized lithium production have occurred in Argentina, Bolivia, and Chile. Mexico, Bolivia and Chile have nationalized their mineral resources to protect them from multinational capitalistic exploitation and are joining with other nations worldwide to ban deep-sea mining in international waters.[17] Additionally, the economic, cultural and spiritual sovereignty of the Puna de Atacama’s diverse Andean Indigenous people has become a worldwide concern.[18]

In years past, the United States was the world’s largest supplier of lithium. The first commercial source of lithium came from the Kings Mountain Mine, in North Carolina’s Tin-Spodumene Belt. This hardrock mine began operating in 1938 and was the primary lithium source until it closed fifty years later when the new, more economical lithium brine evaporitic technique went into production in Chile in the 1980s.[19] Through the mid-1990s, thirty-seven percent of the world’s 9.5-kiloton supply continued to originate stateside, but over the past twenty-five years, domestic production waned while worldwide demand soared. In 2023, 180,000 metric tons of lithium were mined worldwide, 34,000 more tons than the previous year.[20]

Silver Peak, located in Clayton Valley, about forty miles west of Tonopah, Nevada, was the first continental evaporitic brine operation worldwide when production began in 1967. Today, Silver Peak is the only lithium mine in the country producing LCE at scale. North Carolina-based Albemarle Corporation, the world’s largest lithium producer with operations worldwide, manages Silver Peak. Albemarle transformed the industry when it implemented the evaporitic brine technology developed at Silver Peak at its salar mine in Chile in 1984. Currently, Silver Peak produces about 6,000 metric tons of LCE each year across 4,171 acres of evaporation ponds, with sixty-five employees. The amount of LCE produced is negligible compared with what is produced in Australia and Puna de Atacama, but Albemarle has plans to expand its Silver Peak operations. The company was fined more than $218 million by the U.S. Department of Justice and the Securities and Exchange Commission in September 2023 for bribery and corruption in multiple foreign countries and for other tax-related violations.

The Biden-Harris administration’s 2022 Inflation Reduction Act (IRA), requiring eighty percent of “critical minerals” used in American-made EVs to be sourced domestically or from countries that have free trade agreements with the U.S., has driven car manufacturers and their suppliers to locate reliable domestic lithium supply chains and other minerals it deems critical.[21] But like all highly sought-after natural resources, extraction of known lithium deposits is not without controversy—most of these deposits are located on or adjacent to tribal and multi-use public lands that are culturally and ecologically significant. Indeed, 97 percent of nickel, 89 percent of copper, 79 percent of lithium and 69 percent of cobalt are located within thirty-five miles of Tribal reservations in the U.S.[22] Environmentalists and water resource managers contend that new lithium extraction projects may cause irreversible groundwater contamination and depletion, destroying pristine wilderness areas and dewatering communities with strong economic ties to the land.

Critics of the burgeoning clean energy economy see it as a continuation of century-old settler-colonial exploitation of wildland and cultural landscapes of the American West. They contend that the mining industry employs the same legal instruments manifested in the reconstruction-era General Mining Act of 1872 to dispossess Native Americans of their ancestral lands while greenwashing its extraction practices to take advantage of lucrative federal and state subsidies.[23] Every multinational company involved today has conveniently transformed its business model to emphasize a role in fighting climate change and promoting sustainability without mentioning the long-term impacts on the environment and rural communities where these mines operate.

News media across the U.S. are proclaiming that “The world’s richest known lithium deposit…” is in its backyard, but for now, the epicenter of the nation’s lithium boom is Nevada, the second highest-grossing mineral-producing state in the continental U.S.[24] A close runner up is California’s “Lithium Valley,” which has the potential to surpass Nevada.[25] In Nevada, the frenzy to locate “white gold” has been well under way; as of February 29, 2024, the Nevada Division of Minerals Open Data Site estimates that 21,897 “active, file, and submitted placer claims, presumably for lithium (or lithium brine) in eighteen different hydrographic basins.”[26] Exploratory drilling, sometimes 3,000 to 4,000 feet below ground, is conducted to sample sediments and brines for their potential economic worth. This exploration phase is not benign—new roads and staging areas must be constructed to access, in most cases, undisturbed public land where the lease is located. Vehicles entering and exiting create dust and noise and disturb resident wildlife and frontline communities.

Canadian-owned Lithium Americas disclosed that over the forty-one-year life of its controversial Thacker Pass claystone lithium mining project at northern Nevada’s McDermitt Caldera, 354 million cubic yards of toxic clay tailings will be generated,[27] along with two tons of CO₂ for every ton of lithium produced.[28] Mining lithium claystones involves many of the more destructive aspects (blasting, roasting, acid leaching) that plague traditional hardrock mining methods; the sulfuric acid plant will require 5,800 tons of acid daily to leach lithium from the claystone.[29] The open-pit mine disturbance area will eventually engulf 5,695 acres of remote Great Basin open-range land that is the ancestral homeland of the Fort McDermitt Paiute and Shoshone Tribe, who call it Peehee Mu’huh, or “rotten moon,” where thirty-one ancestors were massacred in 1865 by U.S. soldiers in the crescent-shaped caldera that formed over sixteen million years ago when a super volcano erupted. The Paiute and Shoshone consider Thacker Pass a sacred cultural landscape. The mine is one of two separate claystone lithium operations planned across the vast caldera region, which spans Nevada and Oregon.[30]

Lithium Americas, through its U.S.-based subsidiary Lithium Nevada, has applied for a $1 billion low-interest loan from the U.S. Department of Energy to develop the reserve for General Motors. Through this framework, foreign-owned multinational mining companies can mine valuable metallic mineral resources without paying royalties on their profits. These corporations are eligible for lucrative federal government grants, loans and other incentives to do business stateside. Mining companies have claimed $300 billion worth of minerals across 3.2 million acres of federal land for more than 150 years without returning a cent to the American public—while leaving taxpayers with billions in cleanup costs for abandoned mines when their mine operators go bankrupt.[31] Additionally, lands previously conveyed out of the public domain into private ownership through the suspended patenting system have been purchased for pennies on the dollar.

With Nevada’s longstanding bipartisan backing of the mining industry, it is no surprise that 83 of the 130 lithium mines proposed throughout the West are in the Silver State.[32] Esmeralda County, home of the Silver Peak mine, and northern Nye County are ground zero for lithium prospecting, but other counties have numerous claims. Currently, there are forty-seven lithium mines in the feasibility, exploratory or planning stages within fifty miles of the Silver Peak operation, including Ioneer USA’s 7,166-acre Rhyolite Ridge boron-lithium project comprising 263 unpatented claims where a critically endangered flower called Tiehm’s buckwheat (Eriogonum tiehmii) thrives on only ten acres of lithium-rich land in the center of this proposed, Australian-owned open pit mining operation. An endemic, dull sage-colored shrubby plant featuring dainty yellow pompom flowers during springtime, this buckwheat grows in one of the most extreme habitats imaginable—and nowhere else. Indeed, the botanist who discovered it in 1983 and for whom it is named dryly stated that one could wipe out the entire species with a bulldozer in a matter of hours.[33]

The contentious battle to save the Tiehm’s buckwheat from extinction has been well publicized and is rife with intrigue. The saga began in 2018 when whistleblower Dan Patterson, an environmental protection specialist at the Bureau of Land Management (BLM) Battle Mountain District Office, notified Patrick Donnelly, the Great Basin Director for the non-profit Center of Biological Diversity, that Ioneer was conducting exploration for a mining project where a vulnerable species was present and very likely qualifies for protection under the Endangered Species Act. From there, the battle to protect the plant unfolded like an eco-drama playbook: bullying by BLM higher-ups; buckwheat plants mysteriously disappearing in 2020 after Ioneer posted a “wanted poster” at the general store in in nearby Dyer, Nevada, offering a $5,000 reward to locate other buckwheat populations; to the surprising fast-tracked endangered species listing in December 2022. For now, Ioneer presses on with its plans for operation, waiting for a $700 million federal conditional loan to materialize—all for a mine poised to generate an eighth the amount of lithium compared with the huge volume of China-destined boric acid it will produce in a year during the mine’s expected twenty-six-year life.[34]

This enormous uptick in Nevada’s active lithium claims is partially driven by the archaic federal mine claim location system implemented in 1872. The Biden-Harris Administration’s Interagency Working Group on Mining Laws, Regulations, and Permitting (IWG) released a September 2023 report calling for much-needed reforms of this outmoded law, including replacing claim location staking with a similar leasing system required for extracting oil, gas, and coal on federal lands. Notably, the U.S. and Canada are the only countries that do not regulate and manage hardrock mineral resources, including gold, silver, nickel, and copper, through governmental leasing programs. Supporters of mining reform propose that federal land managers should identify critical mineral-rich mining districts for lease and drastically raise claim maintenance fees to encourage timely mineral development. At the same time, reformers support discouraging speculative claim-holding or poorly planned projects that unnecessarily destroy pristine habitat and water resources for short-term economic gain.

The IWG report additionally calls for a royalty of four to eight percent imposed on all hardrock and other mineral resources, including lithium mined on federal lands,[35] to fairly compensate the American taxpayer and the surrounding communities directly impacted by these activities. In contrast, energy companies typically pay eight to seventeen percent to extract coal, oil, and gas within U.S. public land and waters—representing billions of dollars in federal revenue.[36] Taxes and fees would fund costs to conduct mine permitting, environmental reviews, and reclamation of abandoned legacy mining sites, which number over 500,000 and have cost the American public $50 billion to remediate.[37] The proposed law will keep repeating “bad actors” who fail to clean up their messes from further operating.

More importantly, there is a need to ensure that hard-won environmental safeguards such as the Environmental Protection and Clean Water Acts “are not circumvented, repealed, or weakened for mining, regardless of the importance of the targeted resource.” The primary agencies responsible for managing mineral resources include BLM and the U.S. Forest Service (USFS).[38] Both are understaffed and lack resources, funding, and skilled staff with expertise in mining due to downsizing and retirements, which often lead to inconsistency, redundancy, and poor management of natural resources. Aware of shortcomings and internal challenges, the IWG report stresses the need for interagency coordination, cooperation, and alignment of regulations during the review and permit process. Such efforts should therefore involve the public and all stakeholders, including Tribal and other frontline community members, along with environmental, labor and local government representatives at all development stages. Such a process would ensure future environmentally and socially responsible mining practices—before the onslaught of future mineral exploration and development proposals become unmanageable and are compounded further.

From the industry’s position, the planning, permitting, environmental reviews, and other regulatory oversight are unnecessarily drawn out and require streamlining. With the huge influx of new and future mining activity under their respective authorities, the BLM, USFS, and other involved agencies are under-resourced and not equipped to handle the heavier workload. The IWG report addresses these issues, noting delays as a threat to national security, especially as mining operations can take many years to begin production. However, watchdog groups like Earthworks contend that fast-tracking critical mineral exploration projects without thorough multi-agency regulatory oversight is problematic on many levels—mining continues to be perceived as the “highest and best use” of public lands, taking precedent over all other competing uses, including recreation, hunting, grazing, oil and gas drilling, as well as renewable energy. This is accepted without considering the resource’s ecological value, sensitivity, or protection status.

For example, Vancouver-based Rover Critical Minerals is moving forward with its proposed “Let’s Go” lithium exploration in the Amargosa River watershed just north of Ash Meadows National Wildlife Refuge, home of the greatest number of endemic species found in a local area within the U.S.,[39] including the exceedingly rare Devils Hole pupfish (Cyprinodon diabolis), which persists at the surface of a submerged limestone cavern leading into a vast fossil water aquifer whose depth is not known. I wrote extensively about Ash Meadows and the Devils Hole pupfish in my 2015 dispatch series, Divining Devils Hole. Ash Meadows and its endemic wonders were nearly erased by development plans in the mid-twentieth century, but those plans were thankfully halted when conservationists intervened. Today, a thriving but fragile habitat of restored wetlands and native mesquite bosques, fed by thirty springs and seeps, covers 23,000 acres in western Nevada.

Contributing to the region’s interconnected hydrologic flows is the Amargosa River, a section of which is federally designated as a Wild and Scenic River that plays “hide-and-seek” along most of its 185-mile route, appearing and disappearing before emptying into Badwater Basin in Death Valley National Park. Fairbanks Spring, fed by the river and the vast, underground Death Valley Regional Groundwater Flow System is home to two of the refuge’s endemic species, the Endangered Ash Meadows Amargosa pupfish (Cyprinodon nevadensis mionectes) and Ash Meadows speckled dace (Rhinichthys osculus nevadensis). The spring is roughly 2,000 feet from several of Rover’s twenty-one proposed boreholes. The company acknowledges that it is likely to tap into groundwater everywhere it drills for lithium core samples—which could negatively alter the flow of the river into Ash Meadows by initiating a catastrophic dewatering event. The Amargosa Conservancy is leading the fight against Rover’s exploratory project, which was temporarily stopped in July 2023 when the BLM rescinded approval of the project, citing the potential environmental impacts to the refuge and the species it hosts. However, Rover submitted a revised plan of operations to the BLM in December.[40] Despite strong public, environmental and local government opposition, Rover continues to advance the project, as made clear on its website’s homepage, which displays a drone-shot video clip of the proposed claystone lithium pit mine site on 8,300 acres of public land adjacent to the refuge. Nowhere in its investor promotion materials does it mention the planned mine’s proximity to the protected national wildlife refuge.

Rover’s blatant disregard for the historic and hard-won fight by conservationists nearly fifty years ago to protect Ash Meadows and the Devil’s Hole pupfish is a perfect example of why the 1872 mining law must be overhauled. Herein lies the problem: the Biden-Harris Administration and the Department of Defense are fast-tracking critical mineral projects without a clear and informed understanding of what environmentally and culturally sensitive areas should be permanently withdrawn or off-limits to mining interests. Better coordinated interagency identification and mapping of areas with the highest “critical mineral” resource potential that considers competing resource values is warranted. Under the current law, mineral prospectors can disregard the competing resource values because they know their industry’s exalted status as “highest and best use.” The BLM is legally obligated, according to the existing law, not to hinder and to allow mining exploration and development in any federal lands open to disposal. The BLM and USFS are mandated to facilitate extraction-industry interests above all other competing uses, and critics contend these agencies do so proactively.

As Patrick Donnelly commented in Grist in February 2023, “We just give out mining permits to anybody, for any mining proposal, wherever it is. If the mining industry [wasn’t allowed to] propose such terrible mines, maybe they wouldn’t get fought so much.”[41] Until the 1872 mining law is legislatively reformed to reflect a contemporary and balanced use of the land that does not favor the extraction industry over competing land uses or other stakeholders and, when appropriate, withdraws ecological and cultural “special places” permanently from mineral exploration and development, more environmentally and socially responsible mining cannot occur.

Investors are pressuring extraction companies to overhaul operations and shift to more sustainable mining standards. Good-faith companies work with the Initiative for Responsible Mining Assurance (IRMA), which provides “credible, independent, third-party auditing and transparency at mine sites” and is endorsed by the non-profit Earthworks. For years, Earthworks has supported frontline communities in keeping extraction industries in check “while promoting a just and clean energy future.” Since 1988, Earthworks has lobbied for mining law reform.

Current legislative efforts are underway to overhaul the 1872 mining law. The 2023 Clean Energy Minerals Reform Act, introduced by US Senator Martin Heinrich (D-NM) and US Representative Raúl Grijalva (D-AZ), would amend the law, require tribal consultation, and essentially mirror the reform proposals of the IWG report. Of course, these regulatory reforms are urgently needed but unlikely in the current legislative climate. However, some states are setting their own rules: Several towns in Maine have passed bans on industrial mining. The state’s 2017 Metallic Mineral Mining Act requires a hefty mining application processing fee of $500,000 that discourages speculative operators.

At press, it seems likely that the least environmentally destructive and most productive lithium extraction operations will not be in Nevada but in California’s newly christened “Lithium Valley,” which lies about 150 miles southeast of Los Angeles. There, at the Salton Sea’s southern edge, a group of young volcanoes located between the infamous San Andreas and Brawley fault zones host the “Salton Sea Known Geothermal Resource Area” (KGRA), which currently produces about 400 megawatts (MW) of renewable geothermal-produced electricity round the clock at its eleven power plants with the potential to generate up to 2,950 MW. This detail is important because the super-heated, high-pressure geothermal brines pumped from the hydraulically separated deep diapir 2,000 to 10,000 feet below the Salton Sea produce “flash-steam” that powers the electrical turbines, and these brines contain dissolved lithium and substantial quantities: Enough lithium to produce over 382 million EV batteries. This exceptional lithium resource has the potential to produce 175,000 metric tons of LCE annually by the end of the decade[42]—nearly thirty times the lithium currently being produced yearly at Abemarle’s Silver Peak evaporative operation, almost nine times the amount estimated for Ioneer’s planned Rhyolite Ridge claystone mine and nearly three times that of the largest lithium producer, Australia.[43] And these are projections of just one Lithium Valley company.

To do so, proprietary extraction technologies called Direct Lithium Extraction (DLE) are being developed by a handful of companies with the goal of bringing DLE to commercial scale to tap into this vast resource. These efforts presented technical challenges due to the brines’ extreme temperature, highly corrosive nature, and the sheer volume of brine generated, which is 50,000 gallons per minute. Over the past thirteen years, several companies tried to crack the DLE code, and so far three have done so including Controlled Thermal Resources (CTR), San Diego-based EnergySource, and Berkshire Hathaway Energy.

These DLE technologies vary slightly in process; they all incorporate absorption through a closed-loop filtering process to separate lithium from the brine in a method much like desalination—but more complicated. Each brine type and site requires its own recipe, so it is not a one-size-fits-all technology. According to Goldman Sachs, twenty-seven DLE projects are planned, under development, or operational worldwide.

Lithium Valley DLE is a unique process because it is coupled with geothermal power generation to produce nearly net-zero LCE plus renewable electricity on a small physical footprint and in a matter of hours, unlike evaporative mining. After brine cycles through the geothermal energy/lithium extraction facility, the spent solution is reinjected, which is important to maintain continued brine reservoir pressures and to avoid having surface brine ponds that would interfere with agriculture. CTR and ESM both claim that their proprietary DLE technology recovers over 95 percent of the dissolved lithium, whereas evaporitic salar processes only recover up to 60 percent.

DLE is, to date, the “greenest” way to mine lithium and is configurable for continental and oil field brines, so there is considerable interest in the technology succeeding. Indeed, General Motors and Stellantis have invested in CTR; the latter has made a $100 million investment with the company to supply 65,000 metric tons of lithium hydroxide monohydrate (LHM) over a ten-year period. During Phase One, CTR plans to deliver 25,000 metric tons of battery-grade LHM starting in 2025 at its $1 billion Hell’s Kitchen[44] project, which is now under construction.[45] Future phases will include EV battery manufacturing and recycling facilities that, when fully realized and commercially viable at scale, DLE will transform the Imperial Valley’s economic, social and environmental landscape.

Because of this, Lithium Valley Commission was formed in 2020 to evaluate the effects of DLE recovery development on the surrounding environment, economy, and community health, which suffers the highest pediatric asthma rates in the state. The shrinking Salton Sea shoreline, resulting from diminishing inflows and natural evaporative processes, exacerbates the area’s poor air quality when dust storms emanate from the exposed lakebed, but Imperial Valley’s $4.4 billion agribusiness and its nutrient runoff into the Sea is likely the main cause of the region’s toxic playa dust and elevated respiratory illness.

The commission brought together local, county, and state government officials who met with industry, Tribal, environmental, and environmental justice representatives to review and guide lithium recovery opportunities for the state and frontline communities where these operations take place. Over three years, the commission hosted public outreach forums to discuss impacts on water, wildlife, public health, and Indigenous cultural landscapes.[46] This concerted effort to address diverse community stakeholder concerns and make the appropriate changes when possible is a model for active and transparent public engagement that all extraction companies should abide by worldwide. The commission recommended a DLE training program through regional community colleges, with the industry committed to hiring a local workforce and providing high-paying union jobs. To ensure that Imperial Valley directly benefits from this regional resource, California passed a tiered per-ton lithium tax in 2022, with 80 percent of tax revenues going to Imperial County and the remaining 20 percent for much-needed Salton Sea restoration efforts.[47] When taxed lithium production is operating at full scale, these revenues, estimated in the millions, will completely transform the agricultural-centered Imperial Valley region—if state voters do not repeal the tax in November 2024.[48]

However, while industrial extraction processes are far from benign, many Lithium Valley stakeholders remain cautiously optimistic. Some are not convinced that further degradation of the Salton Sea habitat, which hosts over 400 different bird species, will not result from this new industrial transformation of the landscape. Others are concerned with the toxicity of the waste stream it will create; others fear the destruction of Indigenous cultural landscapes or wonder if seismic activity will accelerate from increased brine pumping and reinjection, although the 2023 Department of Energy report “Characterizing the Geothermal Lithium Resource at the Salton Sea” refutes this claim. As with any novel technology, there are many unknowns. The number-one concern on every stakeholder’s mind is water, and for good reason. According to the EPA, 40 percent of western U.S. watersheds have been polluted by extraction activities, with hardrock mining identified as the nation’s largest toxic polluter.[49]

All mining conglomerates must grapple with water use, and the out-of-sync 1872 law enables them to use as much as they want while fouling it. Associated Press reported in 2019, “Every day many millions of gallons of water loaded with arsenic, lead and other toxic metals flow from some of the most contaminated mining sites in the U.S. and into surrounding streams and ponds without being treated.”[50] Consider that Nevada, the nation’s largest producer of gold, currently allows new mines to begin operations with full disclosure that they will pollute the surrounding watershed—possibly in perpetuity.[51]

Lithium mining, in its many forms, also contributes to water pollution and contamination. New technologies like DLE may cause less pollution than modern gold mining that uses cyanide heap leaching or the sulfuric acid extraction process required for claystone and hardrock lithium mining, but because DLE technology is in its infancy, more research is needed. Nevertheless, the sheer volume of water required for all types of lithium production is staggering.

In 2022, Albemarle’s Silver Peak mine pumped 190 to 222 million gallons of fresh water and 4.55 billion gallons of lithium-rich brine from groundwater reserves for its evaporative operation.[52] This equates to at least 790,000 gallons of combined fresh water and brine for every metric ton of LCE Silver Peak produced that year.[53] According to Arizona State University’s Howard Center for Investigative Journalism’s Lithium Liabilities reportage, the company plans to increase brine pumping by the end of 2025 to 6.5 billion gallons, Albemarle’s maximum 20,000 acre-feet allotment per year, which hydrologists state can negatively affect the region’s groundwater reserves permanently, pushing Clayton Valley’s over-appropriated groundwater basin well beyond the annual recharge rate. This is only one mining operation—there are eleven mines in various stages of development in the valley.

Just west of Silver Peak, the proposed Ioneer Rhyolite Ridge lithium-boron claystone mine will use 1.3 billion gallons per year in full production.[54] Further north, Lithium America’s Thacker Pass claystone mine project will require 1.7 billion gallons of water annually, according to the BLM’s Thacker Pass Lithium Mine Project Final Environmental Impact Statement (EIS).[55] Combined DLE operations at Lithium Valley starting in 2025 are projected to consume 3.2 billion gallons of imported water yearly—around 80,000 gallons per metric ton of lithium hydroxide produced, requiring these companies to negotiate with the Imperial Irrigation District (IID) to gain access to Colorado River water over which the IID holds senior water rights.[56] These projections do not include Berkshire Hathaway Energy’s estimated water use or any future DLE startup. Still, the reader should consider that the IID uses about 3.1 million acre-feet or one-fifth of Colorado River water annually.[57]

Expansion at Albemarle’s Silver Peak operation may be on hold in the short term. In mid-February 2024, Albemarle CEO Ken Masters announced lithium prices are “unsustainable” due to less-than-desirable fourth-quarter results from slowing demand and oversupply. He continued, “The economics for new greenfield projects, particularly in the West, are not supported.” Poorly financed, purely speculative or controversial projects may stall or be scrapped altogether. More environmentally friendly but nascent technologies like DLE may suffer, but they have an economic advantage over hardrock lithium mining. Dr. Michael McKibben, a geochemist and economic geologist at U.C. Riverside, who came out of retirement to work with a team to assess the Salton Sea’s lithium resource potential, stated in a 2023 Berkeley Lab presentation that when DLE is achieved at scale with geothermal, continental, and oil field brines, hardrock lithium mining may no longer be economical within ten years.[58] Indeed, ExxonMobil, Standard Lithium, and others are constructing drilling and production facilities in the oil-rich southern Arkansas Smackover Formation, often with existing bromine-processing infrastructure, to produce lithium from the highest concentrated lithium brine found in North America.[59] Plus, the future of clean energy includes other battery technologies, including sodium-ion and solid-state, along with advances in hydrogen fuel cells.

Like all past extraction booms, there will be winners and losers in this white-gold frenzy. Spot lithium prices drastically rose during 2022. According to the USGS, lithium carbonate traded at $76,000 U.S. in China in January 2023, dropping precipitously to $23,000 a metric ton in November of that same year.[60] The price continued to soften in 2024, with LCE trading at just over $15,000 U.S. in early March. The industry stresses that continued demand for lithium in the long term will remain, and this is indeed likely. Environmentalists, conservationists, ranchers, and water managers who worry about the overall interconnected health of the land and the water underneath it understand that irreversible, permanent damage will ensue if these landscapes and resources are not managed in a long-term, balanced manner.[61] These arid places are some of the last intact, unindustrialized landscapes and wildlife corridors of the West, where people, animals, plants, insects, birds, rocks, mountains, and life-giving springs continue to thrive. These are places that somehow have escaped being bent to our insatiable consumptive will and demands. I don’t want to see Tiehm’s buckwheat—which took an eternity to evolve, sacrificed for a mine that operates for a mere twenty-six years.

Throughout this dispatch and in past Mojave Project field dispatches, we have referenced public lands, federal lands, and the public domain. Reviewing these terms through a decolonization lens, one must consider that the creation, plotting, and distribution of real estate in the United States and elsewhere is a “history rooted in Indigenous dispossession” enabled by the early colonists’ doctrine of discovery, which allowed Europeans to claim and possess undiscovered lands as their God-given right—one that this author and many others dispute, including the United Nations, which adopted the Declaration on the Rights of Indigenous Peoples in 2007. Although the United States and four other countries voted against the resolution, all have reversed their position and now support the declaration.

Opening image of the boron-lithium claystone deposit at Rhyolite Ridge near Dyer, Nevada. Pictured at the upper right side are winter-dormant Tiehm’s buckwheat critically imperiled by Ioneer’s proposed mining project. Photo: Kim Stringfellow.

Did you enjoy reading this dispatch? Consider supporting us with your tax-deductible donation.

Click here to learn more.

FOOTNOTES (click to open/close)

[1] Castle Bravo, discharged on March 1, 1954, at Bikini Atoll, Marshall Islands, remains the largest thermonuclear device ever detonated by the United States. “Scientists were shocked when Castle Bravo produced an astounding fifteen megaton yield, making it 1,000 times as powerful as the U.S. nuclear weapons used on Hiroshima and Nagasaki in 1945. The miscalculation occurred because scientists did not realize that the “dry” source of fusion fuel, lithium deuteride, with 40 percent content of lithium-6 isotope, would contribute so greatly to the overall yield of the detonation.” The Soviet Union’s Tsar Bomba, at fifty megatons, holds the record for the largest nuclear device ever detonated. Ariana Rowberry, “Castle Bravo: The Largest U.S. Nuclear Explosion,” Brookings, February 27, 2104.

[2] Failing lithium-ion batteries are notorious for exploding and catching fire due to chemical volatility. Samantha Murphey Kelly, “Lithium-ion battery fires are happening more often. Here’s how to prevent them,”CNN Business, March 9, 2023.

[3] Brian W. Jaskula, “Lithium Mineral Commodity Summary,” U.S. Geological Summary, January 2024.

[4] “Global EV Outlook 2023: Prospects for electric vehicle deployment,” International Energy Agency (IEA).

[5] According to Paul Martin, a Canadian chemical process development expert, there are 850 grams of LCE per EV battery kWh. For instance, the Tesla Model 3 is powered by a 60 kWh lithium iron phosphate (LFP) battery that weighs 1,060 pounds, including 113 pounds of lithium metal. Paul Martin, “How Much Lithium is in a Li-Ion Vehicle Battery?” LinkedIn, November 29, 2017.

[6] Maria L. Vera et al., “Environmental impact of direct lithium extraction from brines,” Nature Reviews Earth & Environment Volume 4 (March 2023): 150.

[7] “Lithium Extraction in Geothermal Brine” (pdf), California Council on Science & Technology (CCST), December 15, 2023.

[8] Dr. Matthieu Harlaux, “Overview of Lithium Deposits in Nevada” (undated Powerpoint presentation), University of Nevada, Reno, Nevada Bureau of Mines and Geology website.

[9] Dwight Bradley et al., A Preliminary Deposit Model for Lithium Brines, U.S. Geological Survey Open-File Report 2013-1006, 1.

[10] The NRDC prefers to call this region “Puna de Atacama” because it more appropriately conveys this unique and significant ecoregion rather than a place valued only for its extractive use by industry and other state actors. James J.A. Blair et al. “Exhausted: How can we stop lithium mining from depleting water resources, draining wetlands, and harming communities in South America,” NRDC, (April 2022): 11.

[11] “Lithium Extraction in Geothermal Brine,” CCST.

[12] In 2023, Australia led lithium production with 86 million tons. Jaskula, “Lithium Mineral Commodity Summary.”

[13] David Shepardson, “Senators urge US to take steps to boost battery production, citing China,” Reuters, November 6, 2023.

[14] Taylor Kuykendall et al. “Net Zero: Mining faces pressure for net zero-targets as demand rises for clean energy materials,” S & P Global Commodity Insights, July 27, 2020.

[15] Lithium hydroxide is more carbon-intensive to produce than lithium carbonate. “GHG emissions intensity for lithium by resource type and processing route,” (graph), IEA, May 5, 2021.

[16] This amount includes combined lithium-rich brines and freshwater sources, with the majority being “fossil water” brines. Freshwater is used in final production stages to produce calcium carbonate. Blair et al. “Exhausted,” 10.

[17] Jessica Corbett, “Chilean President Unveils Plan to Slowly Nationalize Lithium Industry,” Common Dreams, April 21, 2023.

[18] Mario Orospe Hernández, “Raw materials, or sacred beings? Lithium extraction puts two worldviews into tension,” The Conversation, April 21, 2023.

[19] Albemarle, the mine’s current owner, plans to reopen the mine in 2027 along with new a lithium-processing plant in the state. Other proposed lithium mining projects in the state include the controversial Piedmont lithium mine.

[20] Jaskula, “Lithium Mineral Commodity Summary.”

[21] The UC Davis Climate + Community Project critiques the term “critical minerals” as it “originates in relation to national security and war efforts, and it retains a militaristic association with supply chain control and dominance.” Riofrancos et al. “Achieving Zero Emissions with More Mobility and Less Mining,” University of California, Davis, Climate + Community Project, January 2023, 10.

[22] Samuel Block, “Mining Energy-Transition: Metals, National Aims, Local Conflicts,” MSCI, June 3, 2021.

[23] Numerous Native American treaties were broken or rewritten to accommodate the mining rush and settler colonization. Austin Price, “The Rush for White Gold,” Earth Island Journal, Summer 2021.

[24] Arizona is top grossing state from copper mining. https://elements.visualcapitalist.com/mapped-u-s-mineral-production-value-by-state-in-2022/

[25] Outside of the Salton Sea’s Lithium Valley, limited lithium exploration projects exist in California, including two in Panamint Valley. One appears inactive, and the second is in the early exploration stage. Other early-stage California lithium projects include two near Hector, California, and the Standard Lithium project at Bristol Dry Lake near Amboy.

[26] According to the Los Angeles Times, in 2019, California had 2,000 lithium claims staked across 30,000 acres of public land. Louis Sahagun, “A war is brewing over lithium mining at the edge of Death Valley,” Los Angeles Times, May 7, 2019.

[27] U.S. Bureau of Land Management, Thacker Lithium Mine Project Final Environmental Impact Statement DOI-BLM-NV-W010_2020_0012-EIS, December 2020, 4-109.

[28] This figure includes Facility-Wide On-site Operational Emissions during Phases I and II. Thacker Lithium Mine Project Final EIS, 4-78.

[29] Thacker Lithium Mine Project Final EIS, 4-109.

[30] Australian-owned Jindalee Lithium is exploring the same area for an even larger mine in southeast Oregon called the McDermitt Lithium Project.

[31] Regulations, and Permitting, Recommendations to Improve Mining on Public Lands (final report), Biden-Harris Administration’s Interagency Working Group on Mining Laws, Regulations, and Permitting, September 2023, 19.

[32] Patrick Donnelly, Great Basin Director, Center for Biological Diversity, email correspondence with the author, March 15, 2024. Donnelly maintains a comprehensive Google map database of lithium projects across the U.S. at this link.

[33] For a thoroughly engaging and educational video short on Tiehm’s buckwheat at Rhyolite Ridge, see Crime Pays But Botany Doesn’t Plant Extinction, “Green” Energy & Perineum Deli Platters episode at https://youtu.be/yt9QgV22A_Q.

[34] Ioneer’s Ryholite Ridge website states it will produce “~20,600 metric tons of lithium carbonate or ~22,000 of lithium hydroxide and 174,400 metric tons of boric acid per year, on average for life of the mine.” Imelda Cotton, “Ioneer signs offtake agreement with Chinese company for Rhyolite Ridge boric acid,” Small Caps, December 18, 2019.

[35] According to the IWG report, lithium dissolved in subsurface brine on federal lands open to the Mining Law is a mineral deposit subject to disposal under the Mining Law. Regulations, and Permitting, Recommendations to Improve Mining on Public Lands, 15.

[36] Read about Mojave Desert gold mining and the background of the General Mining Act of 1872 in Desert Gold dispatch series in The Mojave Project Reader IV. This series of dispatches is available at this website.

[37] The 1872 Mining Law: Enriching Foreign Companies at Taxpayer Expense for 150 Years (pdf), Earthworks, March 2019.

[38] The BLM is administered by the Department of the Interior, with the Department of Agriculture administering the USFS.

[39] “Ash Meadows National Wildlife Refuge,” U.S. Fish & Wildlife Service.

[40] The Amargosa Conservancy is watching another speculative early-stage project near Ash Meadows being promoted by Battery Mineral Resources.

[41] Blanca Begert, “Mining law has barely changed since 1872. Can Congress agree on a fix?” Grist, February 9, 2023.

[42] Sammy Roth, “The lithium revolution has arrived at California’s Salton Sea,” Los Angeles Times, January 25, 2024. The CTR website states that will produce up to 300,000 metric tons of LCE a year when its facility is fully developed.

[43] Regulations, and Permitting, Recommendations to Improve Mining on Public Lands, i.

[44] Hell’s Kitchen was a boat landing, café, and dance hall on Mullet Island, one of the dormant volcanoes at the Salton Sea Known Geothermal Resource Area. The volcano became an island after the Salton Sea formed in 1905-06. Hell’s Kitchen’s colorful proprietor, Captain Charles E. Davis, had homesteaded there before the flood. His story and others are included in my 2005 book Greetings from the Salton Sea: Folly and Intervention in the Southern California Landscape, 1905-2005 (Santa Fe: Center for American Places, 2005), which was republished in 2011 and now available as a limited collector’s edition at kimstringfellow.com.

[45] “CTR selects Aquatech for its US$ 1 Billion Lithium Hydroxide Facility in California,” (press release), CTR website.

[46] The Blue Ribbon Commission Report on Lithium Extraction in California was published in December 2022.

[47] Luis Gomez, “California Governor Signs Lithium Per-Ton Tax into Law,” Calexico Chronicle, June 30, 2022.

[48] To learn more about lithium extraction in the Imperial Valley, listen to the University of Southern California-produced Electric Futures podcast.

[49] “The 1872 Mining Law” (pdf), Earthworks.

[50] Matthew Brown, “50M gallons of polluted water pours daily from US mine sites,” Associated Press, February 20, 2019. The same criticism applies equally to fertilizer and pesticide runoff from agriculture and other industrial activities.

[51] Jennifer Solis, “Films document threats to water from mines, pipeline project,” Nevada Current, March 26, 2019.

[52] Reporters from the Howard Center for Journalism, “Lithium Liabilities: The untold threat to water in the rush to mine American lithium,” ASU Howard Center for Investigative Journalism, January 25, 2024. Further reading: “SEC Technical Report Summary Pre-Feasibility Study Silver Peak Lithium Operation, Nevada, USA,” SRK Project Number: USPR000574, SRK Consulting, February 14, 2023.

[53] This figure assumes that Albemarle’s Silver Peak mine produced 6,000 metric tons of LCE in 2022, as stated in the company’s February 2023 “SEC Technical Report Summary.”

[54] Alan Halaly, “Inside the rush to make Nevada the country’s lithium capital,” Las Vegas Review-Journal, February 29, 2024.

[55] This amount is based on Phase II water demand of 5,200 acre-feet per year. Thacker Lithium Mine Project Final EIS, 4-7.

[56] CTR will use 6,700 acre-feet or 2.1 billion gallons of fresh water per year, with EnergySource Materials using 3,400 acre-feet or 1.1 billion gallons. Comite Civico Del Valle (CVV) and Earthworks, Environmental Justice in California’s Lithium Valley (pdf), November 2023, 25.

[57] This amount equals 1.1 trillion gallons of Colorado River water used every year for agriculture and municipal water tranfers.

[58] Dr. Michael McKibben, “The Promise and Challenges of Geothermal Lithium,” (archived online presentation), Earth & Environmental Sciences Berkeley Lab, March 17, 2023.

[59] Boyce Upholt, “In Rush for Lithium, Miners Turn to the Oil Fields of Arkansas,” Yale Environment 360, February 29, 2024.

[60] Jaskula, “Lithium Mineral Commodity Summary,” January 2024.

[61] The author acknowledges that places like Imperial Valley, where the majority of winter vegetables are grown in the U.S., will become largely inhabitable if we do not cease using fossil fuels for our transportation and energy grids.